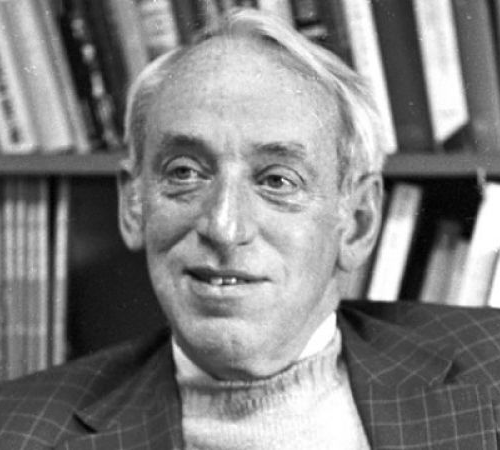

James Tobin, born on 5 March 1918 in Champaign, Illinois, USA, and died at the age of 84 in New Haven, Connecticut, is considered one of the greatest macroeconomists of his generation, and his contributions to economic science earned him the Nobel Prize in Economics in 1981.

He began his studies at a small university near his hometown. After obtaining a scholarship to Harvard University in 1935, he completed his studies in 1939 and his doctorate in 1947. James Tobin worked as an economist for the Office of Price Administration in Washington D.C. from 1941 to 1942.

During World War II, he served in the Naval Reserve, where he was assigned to USS Kearny’s destroyer. By 1950 he joined the faculty of Yale University as a professor of economics, and in 1972 Tobin began working as an advisor to Democratic candidate George McGovern.

Like many economists across the political spectrum, James Tobin pointed out the detrimental consequences of government policies such as a high minimum wage on the job prospects of young people in the inner cities.

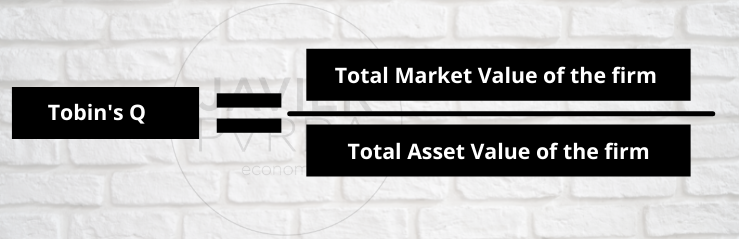

He argued that monetary policy was only effective in one area, capital investment, and that interest rates are vital in capital investment, but not the only factor. One of his most recognised contributions to the world of economics is his “Tobin’s Q“, where he establishes the relationship between the market value of an asset and its replacement cost, which states that if the q of an asset is greater than one, new investment in (similar) assets will be profitable, James Tobin developed this relationship after arguing that companies should be worth what they cost to replace.

Looking at it with a simple example, let’s imagine that our company has €50 million in assets, 5 million shares outstanding and a price of €2 million.

If we use Tobin’s formula, we will have a Q of:

Tobin’s Q= (5,000,000 * 2)/50,000,000

Tobin’s Q=0.20

Tobin received the Nobel Prize in Economics for “his analysis of financial markets and their relationships to spending, employment, production and pricing decisions”. He considered asset pricing theory (especially the Portfolio Separation Theorem) to be a pitfall in constructing reliable financial models.

There is no doubt that James Tobin‘s influence on macroeconomic theory has been so pervasive that it is now part of the professional stock of many economists. We can see that Tobin’s influence remains in many areas of economics as we know it today, thanks to his pioneering work such as the use of time series and cross-sectional data to estimate food demand functions, the debate on fiscal, monetary policy and his work on the measurement of social welfare.