Before we talk about cryptocurrencies, let us think about the evolution of money and how it has changed its presentation and forms of use. It is a clearly identifiable object with an absolute value for all parties involved. Throughout our history, we have gone through different financial transactions, for example, the barter or exchange system, then we came to the precious metal system where coins were introduced and with them came banks, then bills of exchange. Governments created paper notes which gave shape to the paper money we know today.

The whole process that shapes our global monetary system is based on floating exchange rates that depend on supply and demand. However, how our economic data is recorded, sorted, manipulated and stored is still extremely antiquated despite the technological evolution we live in. This is where the Blockchain value comes in, which was created to improve the way we store and record data, especially in the financial world.

When we talk about Blockchain, one of the main applications that come to mind is its use in managing, controlling, and distributing cryptocurrencies. Currently, the terms virtual currency, cryptocurrency, and digital currency are used interchangeably, but we will try to give a concrete definition in this article.

Before we talk about cryptocurrencies, let’s talk about what a virtual currency is. If we go by the definition given by the European Central Bank, it tells us that it is a type of money issued and generally controlled by its developers, that it is not regulated, that it is digital and that its value is based on the acceptance given to it by the members of a virtual community.

What are cryptocurrencies?

A cryptocurrency is an asset created outside the control of the traditional financial system; it is based on the trust and acceptance given by users through a cryptographic system that allows “money” transactions between members of the community.

So we can say that cryptocurrencies (also called cryptos) are a kind of virtual currency that exist thanks to Blockchain technology. The first of these currencies created in 2009 is the best known, “the Bitcoin“, but it is not the only one that exists; it is preceded by Namecoin and Litecoin (created in 2011) by 2018, there were already more than 1500 cryptocurrencies in the world.

Cryptocurrencies are a monetary system, i.e. they do not value the material they are made of or their physical utility. That is what the people in the network who accept their use agree to. Its importance in the market gives the value that a coin acquires. The more people are interested in buying them, the more valuable they are, resulting in an auction.

How do cryptocurrencies work?

According to a report by the European Central Bank in 2015, the cryptocurrency-based system works as follows:

- Creator: There must be a “programmer” who will be the one to create the cryptocurrency and the basis on which it will be based. The creator or creators can be natural or legal persons or remain anonymous behind a pseudonym, as in Bitcoin, created under the pseudonym of Satoshi Nakamoto.

- Maintenance: Once the cryptocurrency and the network that supports it has been created, its creator or creators must remain active for a period of time to provide maintenance and make improvements to it.

- Rules: Subsequently, the rules for creating new units, their rules of use and even the possibility of withdrawing units from circulation have to be set.

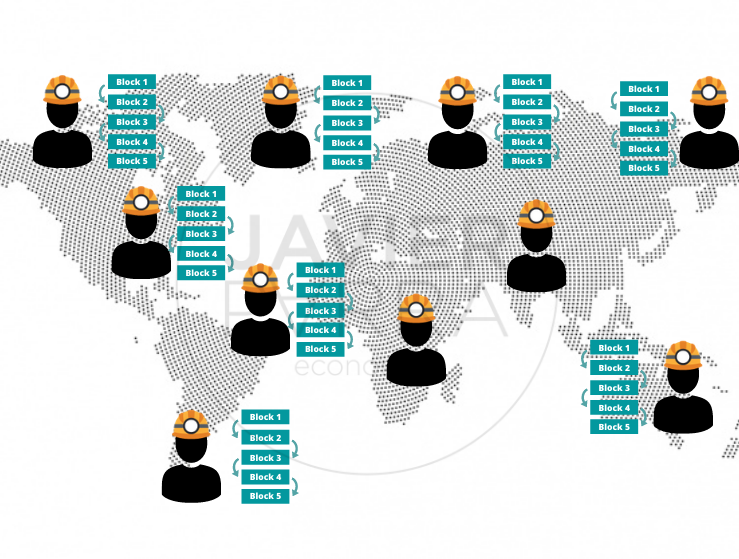

One of the main characteristics of cryptocurrencies is their decentralisation, based on the Blockchain system. Once an order has been entered, it is impossible to remove it, as it is visible to everyone, making the whole process transparent.

The creation of cryptocurrencies is done through the mining process that consists of solving mathematical problems and verifying blocks sent by the user; each contribution is rewarded with a certain amount of cryptocurrencies. Contrary to what many people think, cryptocurrency mining is not that easy to perform as it requires huge amounts of energy and potent computers.

Once the coin has been mined, the miner can decide what to do with it, whether to keep it, exchange it or trade it on the market. It is important to note that not all cryptocurrencies can be exchanged for euros or dollars (only the most commonly used ones can be exchanged). Still, it is possible to acquire some cryptocurrencies from others. The larger the network of users of the cryptocurrency, the more possibilities there will be for its use, increasing its value.